Understanding the $40/hr Salary: What It Means for You

Earning 40 per hour is a significant milestone for many professionals, but what does it truly mean for your financial well-being and career trajectory? Whether you’re negotiating a new job, considering a career change, or simply curious about the value of your time, understanding the implications of a 40/hr salary is essential. This blog will break down the financial, lifestyle, and career aspects of this wage, providing actionable insights for both informational and commercial-intent readers.

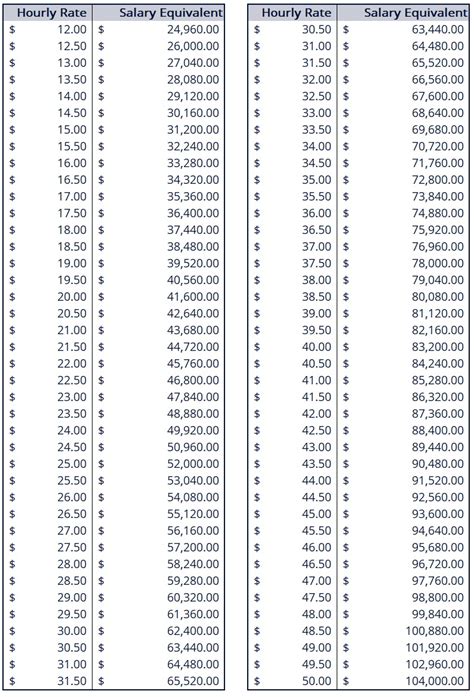

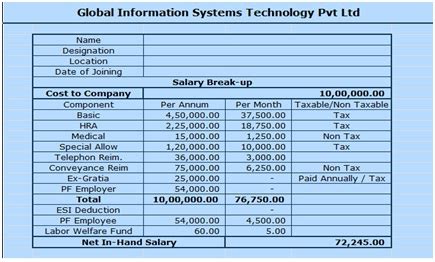

What Does a $40/hr Salary Translate to Annually?

A 40/hr wage equates to 83,200 annually (based on a 40-hour workweek and 52 weeks per year). This calculation assumes full-time employment without overtime. For part-time workers or freelancers, the total income will vary based on hours worked.

| Hours Worked Per Week | Annual Income |

|---|---|

| 40 | $83,200 |

| 30 | $62,400 |

| 20 | $41,600 |

Keywords: annual salary calculator, hourly to salary conversion, part-time earnings

Is $40/hr a Good Salary?

The perception of a $40/hr wage depends on factors like location, industry, and cost of living. In low-cost areas, this salary can provide a comfortable lifestyle, while in high-cost cities like New York or San Francisco, it may be closer to average.

- Pros: Above the median U.S. wage, potential for savings, and career growth.

- Cons: May not cover high living expenses in expensive regions.

Keywords: cost of living, salary comparison, average hourly wage

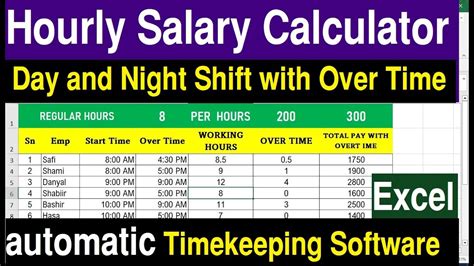

Budgeting on a $40/hr Salary

Effective budgeting is key to maximizing this income. Here’s a simple breakdown:

- 50/30/20 Rule:

- Needs (50%): Housing, utilities, groceries.

- Wants (30%): Entertainment, dining out, hobbies.

- Savings (20%): Emergency fund, retirement, investments.

- Needs (50%): Housing, utilities, groceries.

💡 Note: Adjust percentages based on personal goals and expenses.

Keywords: budgeting tips, 50/30/20 rule, financial planning

How to Negotiate a $40/hr Salary

For commercial-intent readers, negotiating a higher wage is crucial. Follow these steps:

- Research Industry Standards: Use tools like Glassdoor or Salary.com.

- Highlight Your Value: Showcase skills, experience, and achievements.

- Practice Confidence: Role-play negotiation scenarios.

Keywords: salary negotiation tips, job offer negotiation, career advancement

Career Paths That Offer $40/hr

Several professions pay around $40/hr, including:

- IT Specialists: Network administrators, software developers.

- Healthcare Professionals: Registered nurses, physical therapists.

- Skilled Trades: Electricians, plumbers.

Keywords: high-paying jobs, career paths, job opportunities

Maximizing Your $40/hr Income

To make the most of this salary:

- Invest Wisely: Explore retirement accounts (e.g., 401(k), IRA).

- Reduce Debt: Prioritize high-interest loans or credit cards.

- Upskill: Take courses to increase earning potential.

Keywords: investment strategies, debt reduction, professional development

Summary Checklist

- Calculate your annual income based on hours worked.

- Compare your salary to local cost of living.

- Create a budget using the 50/30/20 rule.

- Negotiate confidently with research and preparation.

- Explore career paths that align with your skills.

Keywords: salary checklist, financial planning, career growth

Understanding a $40/hr salary empowers you to make informed decisions about your finances and career. Whether you’re aiming for stability, growth, or both, this wage can be a stepping stone to achieving your goals.

How does $40/hr compare to the average U.S. wage?

+A $40/hr salary is above the average U.S. hourly wage, which is approximately $28/hr.

Can I live comfortably on $40/hr in a high-cost city?

+It depends on your lifestyle and expenses. Budgeting carefully is essential in expensive areas.

What industries typically pay $40/hr?

+Industries like IT, healthcare, and skilled trades often offer wages around $40/hr.

Keywords: salary comparison, cost of living, high-paying industries