Understanding 66 0.53 0.15: Key Insights and Applications

Understanding 66 0.53 0.15: Key Insights and Applications

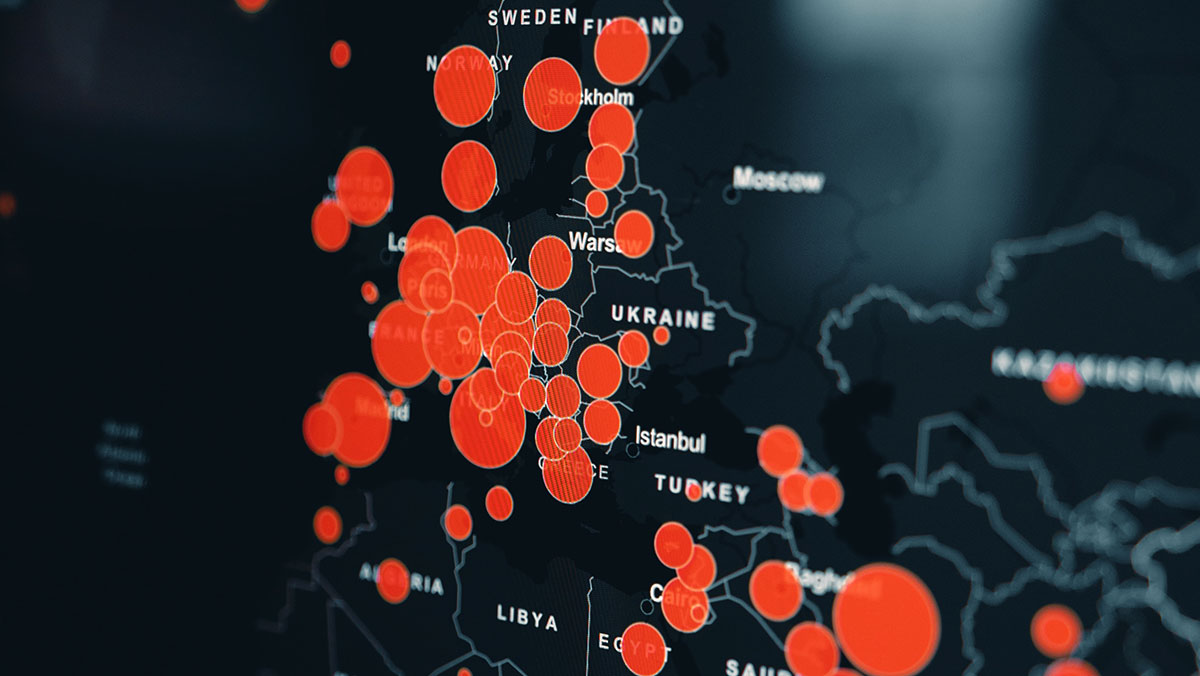

The sequence 66 0.53 0.15 has gained attention across various industries for its unique applications and insights. Whether you’re analyzing data, optimizing processes, or exploring statistical models, these numbers hold significant value. This post delves into their meaning, practical uses, and how they can be leveraged effectively. From data analysis to optimization strategies, we’ll break down the essentials for both informational and commercial audiences.

What Do 66, 0.53, and 0.15 Represent?

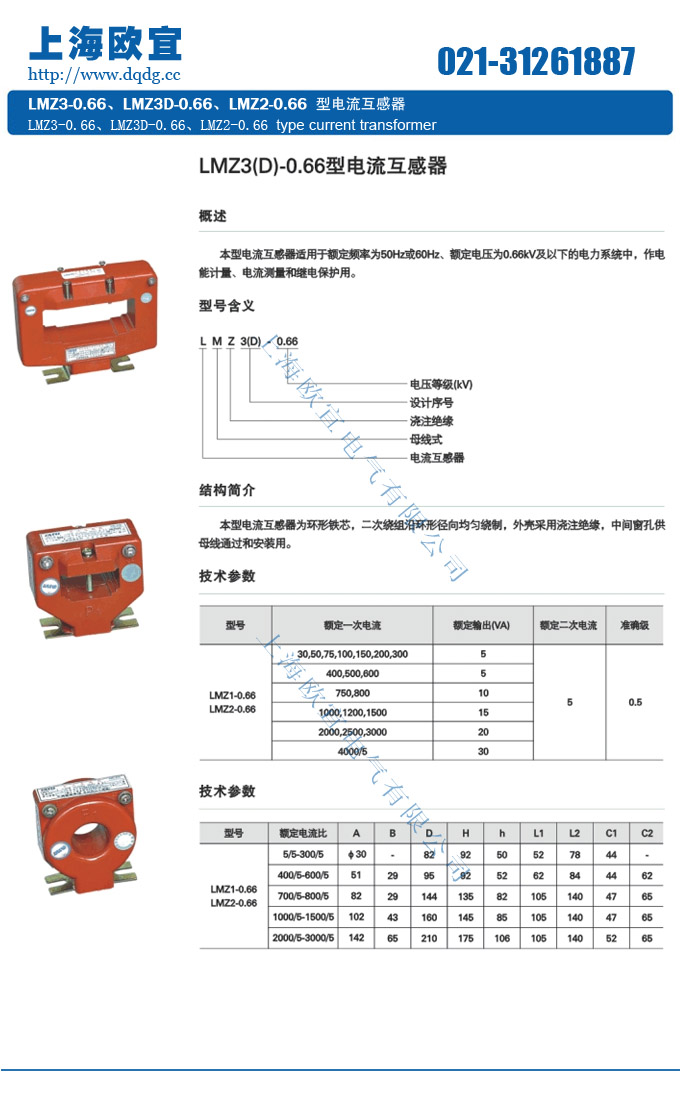

These numbers often appear in statistical, financial, or technical contexts. 66 could signify a percentage, a metric, or a benchmark, while 0.53 and 0.15 might represent probabilities, ratios, or coefficients. Understanding their context is crucial for accurate interpretation.

- 66: Commonly associated with percentages (e.g., 66% completion rate) or thresholds in data analysis.

- 0.53: Often used as a probability or correlation coefficient in statistical models.

- 0.15: May represent a small ratio, margin of error, or adjustment factor.

📊 Note: Always verify the context of these numbers to avoid misinterpretation.

Practical Applications of 66 0.53 0.15

These values are widely applied in fields like finance, technology, and marketing. Here’s how:

1. Data Analysis and Predictive Modeling

In predictive models, 0.53 and 0.15 could represent key variables influencing outcomes. For instance, 0.53 might indicate the weight of a feature in a machine learning algorithm, while 0.15 could be the margin of error.

2. Financial Planning

66 could represent a savings benchmark, while 0.53 and 0.15 might denote investment returns or risk factors. For example, a portfolio with a 66% allocation to stocks and 0.53 expected return could be adjusted by a 0.15 risk factor.

3. Marketing Optimization

In campaigns, 66% might reflect the success rate, 0.53 the conversion rate, and 0.15 the churn rate. These metrics help refine strategies for better ROI.

| Application | 66 | 0.53 | 0.15 |

|---|---|---|---|

| Data Analysis | Threshold | Correlation | Error Margin |

| Finance | Savings Goal | Return Rate | Risk Factor |

| Marketing | Success Rate | Conversion Rate | Churn Rate |

How to Leverage 66 0.53 0.15 for Commercial Success

For businesses, these numbers can drive decision-making and strategy. Here’s how:

- Set Benchmarks: Use 66 as a performance benchmark (e.g., customer retention rate).

- Optimize Campaigns: Adjust 0.53 and 0.15 to improve conversion and reduce churn.

- Risk Management: Incorporate 0.15 as a buffer in financial projections.

💡 Note: Regularly update these values based on real-time data for accuracy.

Checklist for Implementing 66 0.53 0.15

To maximize the potential of these numbers, follow this checklist:

- Identify Context: Determine what 66, 0.53, and 0.15 represent in your specific use case.

- Analyze Data: Use these values to interpret trends and patterns.

- Optimize Strategies: Adjust processes based on insights derived from these numbers.

- Monitor Performance: Track changes and refine approaches as needed.

Wrapping Up

The sequence 66 0.53 0.15 is more than just numbers—it’s a powerful tool for analysis, optimization, and decision-making. By understanding their context and applications, you can unlock valuable insights and drive success in various fields. Whether you’re a data analyst, financial planner, or marketer, these numbers offer a versatile framework for achieving your goals.

What does 66 represent in data analysis?

+66 often signifies a threshold or benchmark, such as a completion rate or target percentage.

How is 0.53 used in predictive modeling?

+0.53 can represent a correlation coefficient or the weight of a feature in a machine learning model.

Why is 0.15 important in financial planning?

+0.15 may denote a risk factor or margin of error in financial projections and strategies.

Related Keywords: data analysis, financial planning, marketing optimization, predictive modeling, statistical insights.