Bernard Arnault's Leveraged Buyout Strategy Explained

<!DOCTYPE html>

Bernard Arnault, the chairman and CEO of LVMH Moët Hennessy Louis Vuitton, is renowned for his strategic acumen in the luxury goods industry. One of his most notable strategies is the leveraged buyout (LBO), a financial maneuver that has significantly contributed to his success. This post delves into Arnault’s LBO strategy, its key components, and how it has shaped his business empire, focusing on leveraged buyout strategy, Bernard Arnault’s business tactics, and LVMH acquisitions.

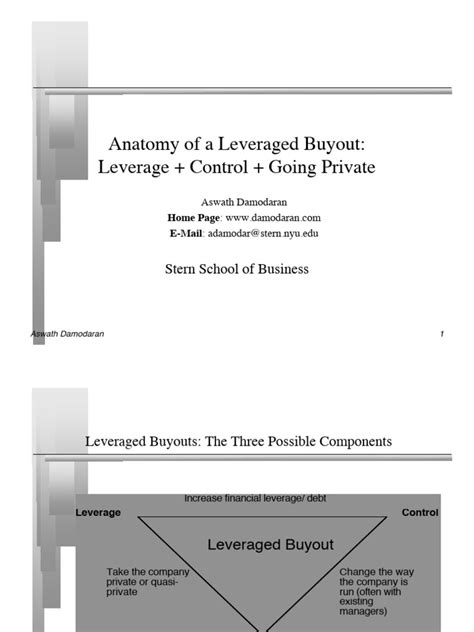

What is a Leveraged Buyout (LBO)?

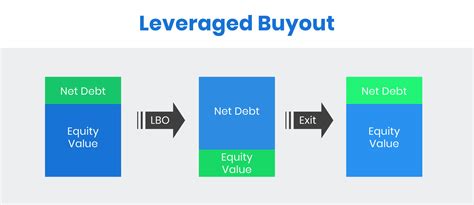

A leveraged buyout is a transaction where a company is acquired using a significant amount of borrowed funds, with the assets of the acquired company serving as collateral for the loans. This strategy allows buyers to make large acquisitions with minimal upfront capital. Bernard Arnault has masterfully utilized LBOs to expand LVMH’s portfolio, often targeting undervalued luxury brands with strong growth potential, such as Christian Dior and Tiffany & Co.

Key Components of Bernard Arnault’s LBO Strategy

1. Identifying Undervalued Assets

Arnault’s strategy begins with identifying luxury brands that are undervalued but possess strong brand equity and growth potential. By targeting these assets, he ensures that the acquisition will yield significant returns once integrated into LVMH’s ecosystem. This approach aligns with luxury brand acquisitions and strategic investments.

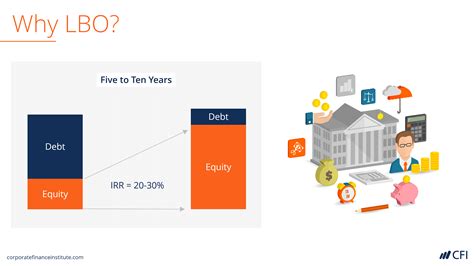

2. Leveraging Debt Efficiently

A critical aspect of Arnault’s LBO strategy is the efficient use of debt. He structures deals to minimize financial risk while maximizing returns. The acquired company’s cash flows are often used to service the debt, ensuring a steady repayment plan. This method is a hallmark of debt-financed acquisitions and financial restructuring.

💡 Note: Efficient debt management is crucial in LBOs to avoid over-leveraging, which can jeopardize the acquired company’s financial stability.

3. Integrating Acquired Brands into LVMH’s Ecosystem

Post-acquisition, Arnault focuses on seamlessly integrating the new brand into LVMH’s existing network. This includes leveraging LVMH’s global distribution channels, marketing expertise, and operational efficiencies. Such integration ensures that the acquired brand benefits from LVMH’s scale and resources, driving long-term growth. This step is essential for brand integration and operational synergy.

Notable Examples of Arnault’s LBO Success

| Brand | Acquisition Year | Outcome |

|---|---|---|

| Christian Dior | 2017 | Strengthened LVMH’s position in haute couture and increased market share. |

| Tiffany & Co. | 2021 | Expanded LVMH’s presence in the high-end jewelry market. |

Checklist for Implementing an LBO Strategy

- Identify undervalued assets with strong growth potential.

- Structure debt financing to minimize risk and maximize returns.

- Develop a clear integration plan for acquired brands.

- Leverage existing resources to enhance the acquired brand’s performance.

By following these steps, businesses can emulate Bernard Arnault’s successful LBO strategy, achieving growth through strategic acquisitions, financial leverage, and operational integration. Leveraged buyouts, when executed correctly, can be a powerful tool for expanding business empires, as demonstrated by Arnault’s transformative deals in the luxury sector, luxury brand acquisitions, LVMH growth strategies.

What is a leveraged buyout (LBO)?

+A leveraged buyout is a transaction where a company is acquired primarily using borrowed funds, with the acquired company’s assets serving as collateral for the loans.

How does Bernard Arnault use LBOs in his business strategy?

+Arnault uses LBOs to acquire undervalued luxury brands, leveraging debt efficiently and integrating them into LVMH’s ecosystem to drive growth and profitability.

What are the risks of a leveraged buyout?

+Risks include over-leveraging, which can strain the acquired company’s finances, and failure to integrate the brand successfully, leading to underperformance.