Beta vs. Delta Stocks: Key Differences Explained

When it comes to investing in the stock market, understanding the different types of stocks is crucial. Two terms that often come up are Beta Stocks and Delta Stocks. While both are essential in portfolio management, they serve different purposes and cater to distinct investor strategies. This post will break down the key differences between Beta and Delta Stocks, helping you make informed investment decisions. (Stock Market Basics, Investment Strategies, Portfolio Management)

What Are Beta Stocks?

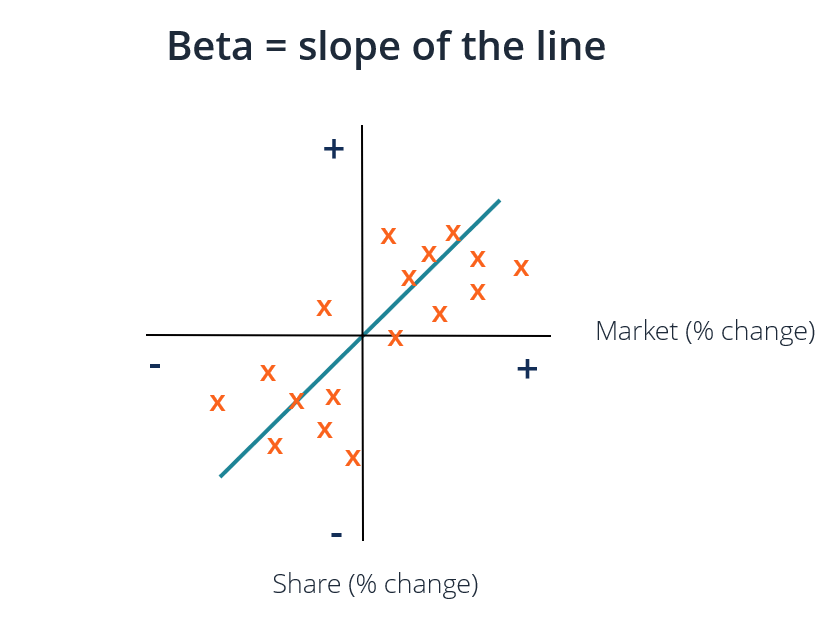

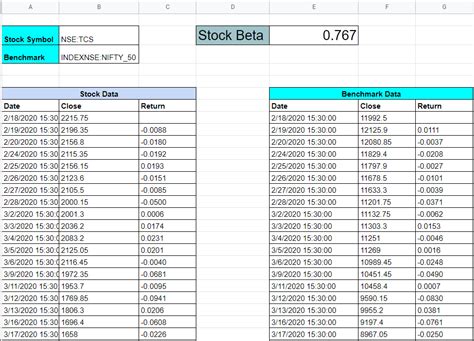

Beta Stocks refer to stocks whose returns are highly correlated with the overall market. These stocks are considered a measure of market risk and volatility. A beta value of 1 indicates that the stock moves in line with the market. For example, if the market rises by 10%, a Beta Stock with a beta of 1 will also rise by 10%. (Market Risk, Stock Volatility, Beta Calculation)

Key Characteristics of Beta Stocks

- Market Correlation: High correlation with market indices like the S&P 500.

- Risk Indicator: Beta values greater than 1 indicate higher volatility, while less than 1 suggests lower volatility.

- Investor Suitability: Ideal for investors seeking market-mirroring returns or hedging strategies.

📌 Note: Beta is calculated using historical data, so it may not always predict future performance accurately.

What Are Delta Stocks?

Delta Stocks, on the other hand, are often associated with options trading and represent the change in an option’s price relative to the change in the underlying asset’s price. Delta values range from 0 to 1 for call options and -1 to 0 for put options. For instance, a delta of 0.5 means the option price will move 0.50 for every 1 move in the underlying stock. (Options Trading, Delta Hedging, Derivatives)

Key Characteristics of Delta Stocks

- Options Focus: Primarily used in derivatives trading rather than direct stock investments.

- Price Sensitivity: Measures how much an option’s price changes with the underlying asset.

- Investor Suitability: Suitable for traders looking to hedge or speculate on price movements.

Beta vs. Delta: A Comparative Table

| Feature | Beta Stocks | Delta Stocks |

|---|---|---|

| Primary Use | Measuring market risk | Options pricing and hedging |

| Range | No fixed range (e.g., 0.5, 1.2) | 0 to 1 (call) or -1 to 0 (put) |

| Investor Focus | Long-term investors | Short-term traders |

How to Choose Between Beta and Delta Stocks

Choosing between Beta and Delta Stocks depends on your investment goals and risk tolerance. If you’re focused on long-term market performance and portfolio diversification, Beta Stocks are a better fit. For short-term traders looking to capitalize on price movements or hedge positions, Delta Stocks (via options) are more appropriate. (Investment Goals, Risk Tolerance, Diversification Strategies)

Checklist for Investors

For Beta Stocks:

- Assess your risk tolerance.

- Align investments with market indices.

- Use beta values to balance portfolio volatility.

- Assess your risk tolerance.

For Delta Stocks:

- Understand options trading basics.

- Monitor underlying asset price movements.

- Use delta values for hedging strategies.

- Understand options trading basics.

📌 Note: Always consult a financial advisor before making significant investment decisions.

Understanding the differences between Beta and Delta Stocks is essential for tailoring your investment strategy to your financial goals. While Beta Stocks focus on market risk and long-term performance, Delta Stocks are tools for short-term trading and hedging. By grasping these concepts, you can build a more resilient and profitable portfolio. (Financial Planning, Investment Tools, Market Analysis)

What does a beta value of 1 mean?

+

A beta value of 1 indicates that the stock moves in line with the overall market.

Can delta values be negative?

+

Yes, delta values for put options range from -1 to 0, indicating inverse price movement.

Are Beta Stocks suitable for beginners?

+

Yes, Beta Stocks are ideal for beginners as they mirror market performance and are easier to understand.