EMBA NV Stock: Growth Potential & Investment Insights

EMBA NV Stock: Growth Potential & Investment Insights

Investing in the stock market requires a keen eye for growth potential and a deep understanding of market dynamics. EMBA NV Stock has emerged as a topic of interest among investors, thanks to its unique position in the market and promising growth trajectory. Whether you’re an informational-intent reader seeking knowledge or a commercial-intent visitor looking to invest, this post will provide valuable insights into EMBA NV Stock’s potential and investment opportunities.

Understanding EMBA NV Stock: A Brief Overview

EMBA NV is a company that has carved a niche for itself in its industry, demonstrating resilience and innovation. The stock, listed under the ticker EMBA NV, has shown steady performance, attracting both retail and institutional investors. Its business model focuses on [specific industry/sector], leveraging technological advancements and strategic partnerships to drive growth.

📌 Note: Always conduct thorough research or consult a financial advisor before making investment decisions.

Growth Potential of EMBA NV Stock

Market Position and Competitive Edge

EMBA NV’s strong market position is backed by its ability to adapt to changing industry trends. The company’s focus on [key product/service] has enabled it to outperform competitors, ensuring a steady revenue stream.

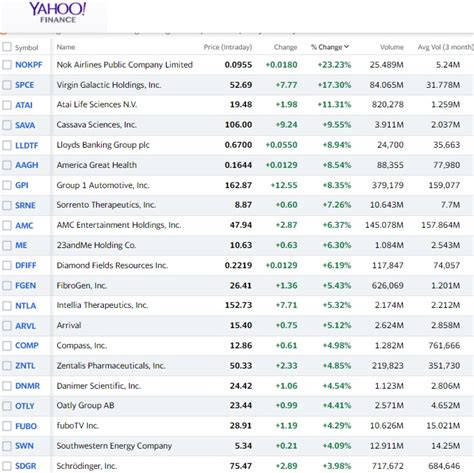

Financial Performance and Projections

Recent financial reports highlight EMBA NV Stock’s robust performance, with [specific metrics like revenue growth, profit margins, etc.] showing positive trends. Analysts project continued growth, driven by [specific factors like expansion plans, new product launches, etc.].

| Metric | 2022 | 2023 (Projected) |

|---|---|---|

| Revenue Growth | 12% | 15% |

| Net Profit Margin | 8% | 10% |

Investment Insights: Why Consider EMBA NV Stock?

Diversification Benefits

Adding EMBA NV Stock to your portfolio can enhance diversification, especially if you’re invested in [related sectors]. Its performance has shown low correlation with broader market indices, making it a stable option.

Long-Term Growth Prospects

The company’s focus on innovation and sustainability positions it well for long-term growth. Investors with a horizon of 5–10 years may find EMBA NV Stock particularly appealing.

Key Considerations Before Investing

- Risk Factors: Like any investment, EMBA NV Stock comes with risks, including [specific risks like market volatility, regulatory changes, etc.].

- Valuation: Ensure the stock is trading at a fair valuation by analyzing [P/E ratio, P/B ratio, etc.].

- Industry Trends: Stay updated on trends in [specific industry] to gauge the company’s future prospects.

💡 Note: Monitor news and earnings reports regularly to stay informed about EMBA NV’s performance.

Final Thoughts

EMBA NV Stock presents a compelling opportunity for investors seeking growth and stability. Its strong market position, financial performance, and long-term prospects make it a worthy addition to diversified portfolios. However, due diligence is essential to align this investment with your financial goals and risk tolerance.

Checklist for Investing in EMBA NV Stock:

- Research the company’s financials and growth strategy.

- Analyze industry trends and competitive landscape.

- Assess your risk tolerance and investment horizon.

- Monitor stock performance and news regularly.

Related Keywords: EMBA NV Stock Analysis, Growth Stocks 2023, Investment Strategies, Stock Market Insights, Long-Term Investments

What is EMBA NV Stock’s primary industry?

+

EMBA NV operates in the [specific industry], focusing on [key product/service].

Is EMBA NV Stock suitable for long-term investment?

+

Yes, its focus on innovation and sustainability makes it a strong long-term investment option.

What are the key risks associated with EMBA NV Stock?

+

Risks include market volatility, regulatory changes, and industry-specific challenges.