Surviving Argentina's Inflation: A Time Traveler's Guide

Argentina’s inflation rate has been a rollercoaster, often leaving residents and visitors alike scrambling to adapt. Whether you’re a traveler, expat, or local, understanding how to navigate this economic landscape is crucial. This guide provides practical tips and strategies to survive and thrive in Argentina’s high-inflation environment. From budgeting to investing, we’ve got you covered. (Argentina inflation survival tips, managing finances in Argentina)

Understanding Argentina’s Inflation: The Basics

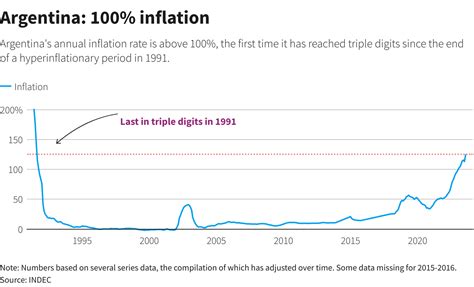

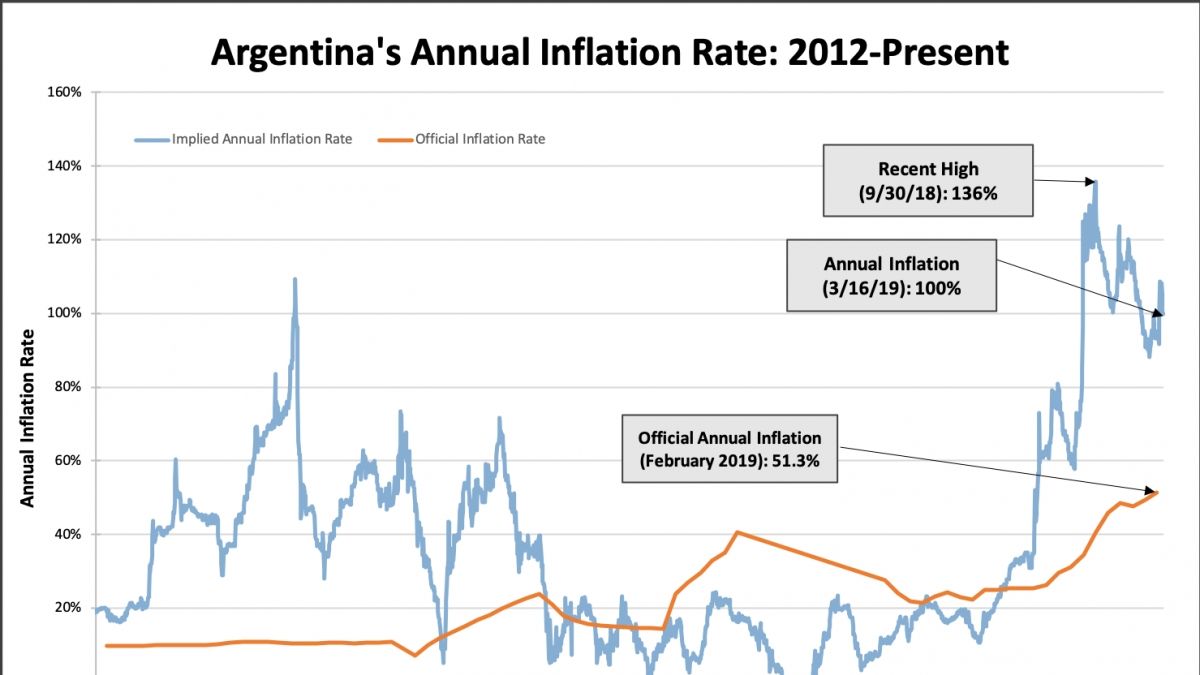

Argentina’s inflation is among the highest globally, often exceeding 100% annually. This economic phenomenon affects prices, wages, and savings, making it essential to stay informed. The primary causes include currency devaluation, fiscal deficits, and external economic pressures. (Argentina economic crisis, causes of inflation in Argentina)

Key Factors Driving Inflation

- Currency Devaluation: The Argentine peso loses value rapidly against foreign currencies.

- Fiscal Policies: Government spending and monetary policies often exacerbate inflation.

- Global Economic Shocks: External factors like rising commodity prices impact the local economy.

Practical Tips for Surviving Inflation in Argentina

1. Budgeting in a High-Inflation Environment

Creating a flexible budget is essential. Prices change frequently, so prioritize necessities and cut discretionary spending. Use budgeting apps or tools to track expenses in real-time. (Budgeting in Argentina, inflation-proof budgeting)

2. Protecting Your Savings

Holding cash in Argentine pesos is risky due to inflation. Consider these alternatives:

- Foreign Currency: Save in stable currencies like USD or EUR.

- Investments: Explore real estate, stocks, or inflation-indexed bonds.

- Digital Assets: Cryptocurrencies can hedge against inflation but carry risks.

3. Smart Shopping Strategies

Prices fluctuate daily, so shop strategically:

- Bulk Buying: Purchase non-perishables in bulk when prices are low.

- Local Markets: Explore feria markets for cheaper fresh produce.

- Price Comparisons: Use apps to compare prices across stores.

Investing in Argentina: Opportunities and Risks

Despite challenges, Argentina offers investment opportunities. Focus on sectors resilient to inflation, such as agriculture, energy, and technology. (Investing in Argentina, inflation-resistant investments)

| Investment Option | Pros | Cons |

|---|---|---|

| Real Estate | Hedges against inflation, tangible asset | High initial investment, liquidity issues |

| Stocks | Potential for high returns, diversification | Market volatility, currency risk |

| Cryptocurrency | Decentralized, inflation hedge | High volatility, regulatory risks |

💡 Note: Always consult a financial advisor before making significant investments in a high-inflation environment.

Surviving Argentina’s inflation requires adaptability, strategic planning, and a proactive approach to finances. By understanding the economic landscape, budgeting wisely, and exploring resilient investment options, you can navigate this challenging environment effectively. Stay informed, stay flexible, and you’ll be well-equipped to thrive in Argentina. (Argentina financial survival, coping with inflation)

What is the current inflation rate in Argentina?

+

As of [latest data], Argentina’s inflation rate exceeds 100% annually, making it one of the highest globally. (Argentina inflation rate, current economic situation)

How can I protect my savings from inflation in Argentina?

+

Consider saving in stable foreign currencies, investing in real estate, or exploring inflation-indexed bonds. Avoid holding large amounts of Argentine pesos. (Protecting savings in Argentina, inflation-proof savings)

Is it safe to invest in Argentina during high inflation?

+

While risky, opportunities exist in sectors like agriculture, energy, and technology. Always conduct thorough research and consult experts. (Investing safely in Argentina, high-inflation investments)